Understanding the Kentucky Medicaid penalty period and penalty divisor for 2026 matters because one mistake can delay nursing home benefits for months and force families to pay out of pocket during a crisis.

In Kentucky, Medicaid applies a strict 60-month look-back period and uses a daily penalty divisor, which often surprises families who thought a gift or transfer was harmless.

For 2026, that daily divisor of $325.41 equals $9,895.72 per month, reflecting the average private-pay cost of nursing home care in Kentucky. Knowing how these rules work before you apply can protect assets, preserve dignity, and prevent unnecessary financial loss.

At Elder Law Guidance, our approach is education-first. We explain Medicaid rules so you understand not just what the penalty period is, but how it affects your family, your timing, and your options.

Key Takeaways

- Kentucky’s Medicaid penalty divisor for 2026 is $325.41 per day, equal to $9,895.72 per month, reflecting the average cost of nursing home care in the state.

- Kentucky applies a 60-month look-back period for long-term care Medicaid.

- The penalty period does not start when assets are transferred. It begins only after a Medicaid application is filed and the person is otherwise eligible.

- Gifts and below-value transfers can delay Medicaid for months, forcing families to pay privately during the penalty period.

- Once assessed, penalty periods are usually fixed, making early understanding and timing critical.

What Is The Kentucky Medicaid Penalty Period?

The Kentucky Medicaid penalty period is a span of time when Medicaid will not pay for nursing home care because assets were transferred for less than fair market value during the look-back period. This penalty applies only to long-term care Medicaid, not regular health coverage.

Kentucky enforces this rule to prevent people from giving away assets shortly before applying for Medicaid. The state treats those transfers as resources that should have been used to pay for care first, so eligibility is delayed instead of denied outright.

Why Kentucky Imposes a Penalty Period for Asset Transfers

Kentucky Medicaid uses the penalty period to control access to long-term care benefits and make sure that applicants contribute available resources toward their care. The rule applies even when the transfer was well-intentioned, such as helping a child, paying off a family debt, or simplifying finances.

The state does not look at why the transfer was made. It looks only at whether value was given up without equal compensation. If it was, Kentucky Medicaid assigns a penalty period based on the value transferred and the state’s daily penalty divisor.

This is where families often feel blindsided. A decision made years earlier, with no thought of Medicaid, can suddenly delay coverage when care is urgently needed.

What Types of Transfers Trigger a Medicaid Penalty in Kentucky

Many families assume only large cash gifts cause problems. In reality, Kentucky Medicaid reviews all financial activity during the look-back period. Penalties are commonly triggered by:

- Cash gifts to children, grandchildren, or other relatives

- Adding someone to a bank account without receiving value in return

- Transferring a home or land for less than fair market value

- Selling assets at a discount

- Forgiving loans or informal family agreements

Each of these transfers reduces countable resources on paper, but Medicaid treats them as if the applicant still had the value available for care.

Once a transfer is flagged, Kentucky Medicaid does not reduce benefits proportionally. Instead, it delays eligibility entirely for a calculated number of days. That delay is the penalty period.

What Is the Medicaid Look-Back Period in Kentucky?

The Medicaid look-back period in Kentucky is 60 months, or five years, and it applies when someone applies for long-term care Medicaid, such as nursing home coverage. During this time frame, Medicaid reviews financial records to see whether assets were transferred for less than fair market value.

The look-back period is not a waiting period. It is a review window. Kentucky Medicaid uses it to look backward at financial activity and decide whether a penalty period must be imposed.

Kentucky’s 60-Month Look-Back Rule Explained

Kentucky’s five-year look-back applies to most transfers made on or after February 8, 2006. When a Medicaid application is filed, the state examines bank statements, deeds, and other records going back 60 months from the relevant baseline date.

If no disqualifying transfers are found, the look-back period ends without consequence. If transfers are identified, Medicaid does not deny the application outright. Instead, it calculates a penalty period based on those transfers.

This rule applies regardless of intent. A gift made out of generosity, tradition, or family support is treated the same as a transfer made for planning purposes.

Common Look-Back Mistakes Kentucky Families Make

Many families unintentionally create problems during the look-back period because they misunderstand how strictly Kentucky applies this rule. Some of the most common mistakes include:

- Believing small or recurring gifts do not matter

- Assuming help given to a child or grandchild is exempt

- Thinking informal agreements or verbal loans will be accepted

- Transferring property within the family without a formal valuation

Kentucky Medicaid relies on documentation, not explanations. If records do not show fair market value was received, the transfer is usually treated as uncompensated.

This is why families often feel confused when Medicaid coverage is delayed. The look-back period reaches far enough into the past that decisions made years earlier can still affect eligibility today.

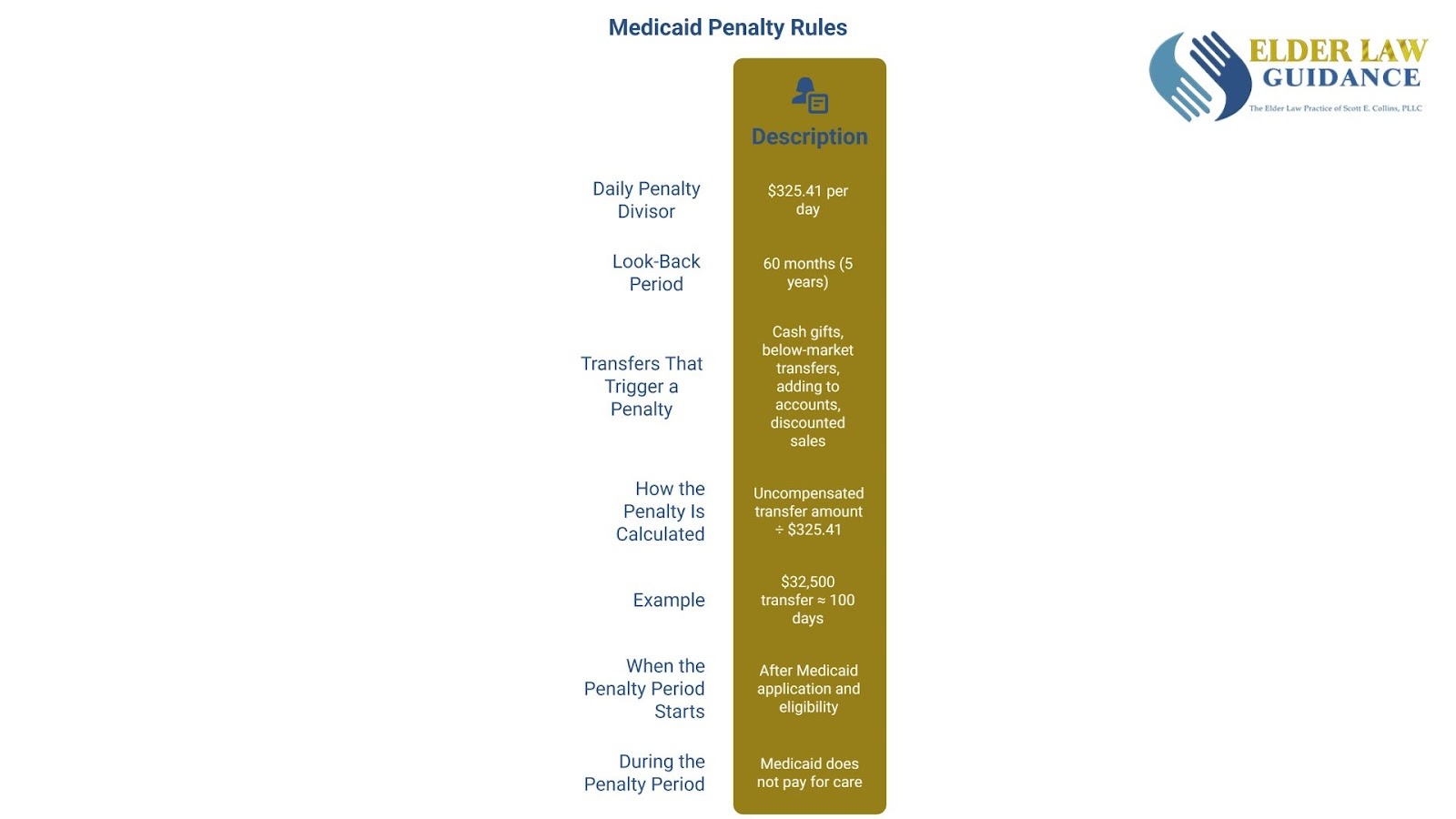

Kentucky Penalty Divisor for 2026 Explained

The Kentucky Medicaid penalty divisor for 2026 is the daily dollar amount the state uses to turn an improper transfer into a period of Medicaid ineligibility. Instead of using a monthly figure, Kentucky applies a daily divisor, which often results in longer and more precise penalty periods.

For 2026, Kentucky’s penalty divisor is $325.41 per day. This number reflects the state’s average private-pay cost for nursing facility care and is used statewide when calculating transfer penalties.

What the Penalty Divisor Represents in Kentucky

The penalty divisor represents what Kentucky Medicaid believes an applicant should reasonably be paying each day for nursing home care.

When assets are given away, Medicaid treats that value as money that could have been used to pay for care at this daily rate. For 2026, Kentucky’s daily penalty divisor of $325.41 equals $9,895.72 per month, which aligns with the average private-pay cost of nursing home care across the state.

Because Kentucky uses a daily divisor, penalty periods are calculated in exact days, not rounded months. This detail matters. Even small transfers can add weeks or months of ineligibility when divided by a daily amount instead of a flat monthly figure.

Why Kentucky Uses a Daily Penalty Divisor

Kentucky’s use of a daily divisor allows Medicaid to assign penalties with precision. Instead of rounding down or ignoring partial months, the state counts every day of ineligibility created by a transfer.

This approach often surprises families. A gift that might look minor on paper can still delay Medicaid coverage because the math continues until the full value of the transfer has been accounted for.

Kentucky updates this divisor periodically based on nursing facility cost data. That means the exact number can change year to year, but the calculation method remains the same.

Get Trusted Legal Support Today

For straightforward legal advice and representation, contact Elder Law Guidance. Call (859) 544-6012 to schedule your consultation.

How Kentucky Calculates the Medicaid Penalty Period

Kentucky calculates the Medicaid penalty period by dividing the total value of uncompensated transfers by the state’s daily penalty divisor. The result is the number of days Medicaid will not pay for long-term care.

This calculation is mechanical. Kentucky Medicaid does not adjust the penalty based on hardship, intent, or family circumstances. Once a transfer is identified, the math determines the delay.

The Formula Kentucky Medicaid Uses

Kentucky applies a straightforward formula:

Uncompensated transfer amount ÷ daily penalty divisor = penalty period (in days)

For 2026, the daily divisor is $325.41 per day. Every dollar transferred without fair value increases the number of days Medicaid coverage is delayed.

Because Kentucky uses days rather than months, the penalty period often feels longer than families expect. There is no rounding down to the nearest month. Each day counts.

Example: How a Gift Creates Months of Ineligibility

Consider a Kentucky resident who gave a child $32,500 within the look-back period. When that person later applies for Medicaid:

- Transfer amount $32,500

- Daily penalty divisor $325.41

- Penalty period: approximately 100 days of ineligibility

During those 100 days, Medicaid will not pay for nursing home care, even if the applicant otherwise meets all income and asset limits.

When the Medicaid Penalty Period Starts in Kentucky

In Kentucky, the Medicaid penalty period does not start when the asset transfer occurs. It starts only after the person has applied for Medicaid and is otherwise eligible for long-term care benefits.

This timing rule is one of the most misunderstood parts of Medicaid planning and one of the most expensive mistakes families make.

Why the Penalty Does Not Start on the Transfer Date

Kentucky Medicaid begins the penalty period when three conditions are met:

- The person is in a nursing facility or approved long-term care setting

- They have applied for Medicaid

- They meet all eligibility rules except for the transfer penalty

Until those conditions are satisfied, the penalty clock does not run. That means a transfer made years earlier can still create a penalty that starts much later, often when care is urgently needed.

Families are often shocked to learn that waiting to apply does not make the penalty go away. In fact, delaying the application can make the financial impact worse because the penalty period has not even begun.

How Timing Errors Increase Out-of-Pocket Costs

Because the penalty period does not start automatically, families may pay privately for months, believing the penalty is already running. In reality, those private payments do not reduce the penalty period unless Medicaid eligibility has been formally triggered.

This is where confusion turns into financial strain. Nursing home costs in Kentucky can exceed several thousand dollars per month, and paying during a period that does not count toward the penalty can drain savings quickly.

What Happens During the Medicaid Penalty Period?

During the Medicaid penalty period in Kentucky, Medicaid does not pay for nursing home care. Even though the person has applied and meets all other eligibility rules, coverage is delayed until the penalty period ends.

This is the stage where families often feel the most pressure, because care is already needed and there is no Medicaid help yet.

Who Pays for Care During the Penalty Period

While the penalty period is running, the responsibility for payment usually falls on the individual or their family. Nursing facilities expect care to be paid for privately until Medicaid coverage begins.

In Kentucky, private-pay nursing home costs commonly reach several thousand dollars per month. Paying those costs during a penalty period can quickly reduce savings, especially when the delay lasts for months rather than weeks.

Facilities generally do not pause billing simply because a Medicaid application is pending. If payment cannot be made, families may face difficult conversations about continued placement or financial guarantees.

Why This Is Where Families Feel Trapped

The penalty period creates a gap where care is required, Medicaid is unavailable, and financial options feel limited. Families may feel they have no good choices, only expensive ones.

This stress is compounded by the emotional toll of watching a loved one decline while trying to manage paperwork, deadlines, and payments. Many families say this is the point where they wish they had understood the penalty rules earlier.

Knowing what happens during the penalty period helps families prepare realistically. It also explains why careful timing and planning matter so much when long-term care decisions are on the table.

Can a Medicaid Penalty Period Be Reduced or Avoided?

Whether a Medicaid penalty period can be reduced or avoided in Kentucky depends on timing, transfer details, and when help is sought. In some situations, the penalty is fixed and unavoidable. In others, planning steps may still limit the damage.

Understanding the difference matters because waiting too long often removes options.

When Medicaid Penalties Are Final

In Kentucky, a penalty period is usually final when:

- Assets were transferred and cannot be recovered

- The transfer occurred within the 60-month look-back period

- Medicaid eligibility has already been triggered and the penalty assessed

Once the penalty period has officially started, Kentucky Medicaid does not shorten it based on hardship or intent. The state applies the rules consistently, even when the outcome feels unfair.

This is why families who act only after receiving a penalty notice often feel stuck. At that point, the focus shifts from prevention to endurance.

When Planning May Still Help

There are situations where planning can still reduce the impact of a penalty period, especially if action is taken before or at the time of application. Timing strategies, proper documentation, and crisis planning techniques may help align eligibility with care needs more carefully.

In some cases, families can avoid unnecessary delays simply by understanding when to apply and how Kentucky calculates eligibility. In others, careful coordination can prevent a penalty from starting later than expected.

Speak With Elder Law Guidance Today!

Families are not looking for shortcuts. They want to understand how Kentucky Medicaid applies the rules, what options still exist, and how to move forward without making things worse. Clear explanations replace panic with direction, especially when siblings, spouses, or caregivers must make decisions together.

At Elder Law Guidance, we believe education-first guidance matters. When families understand how the penalty period, look-back rules, and daily divisor work together, they are better equipped to protect assets, preserve dignity, and make informed choices during an already stressful time.

Contact our offices today to understand all of your options.