Since opening our doors in 2015, Elder Law Guidance has helped Kentucky families protect their homes, organize their legacies, and plan for the future with clarity and confidence.

Many clients arrive feeling unsure of where to begin with estate planning, but as one client shared, “They patiently and carefully guide you through the trust process to help you achieve what you want.” That calm, respectful guidance reflects exactly how we support every family who walks through our door.

Across Kentucky, more than 540,000 households include someone age 65 or older, and long term care costs continue to climb each year. Assisted living now averages about $55,600 annually, while nursing homes often exceed $109,900.

For many families these numbers feel overwhelming, but early planning can protect what you have worked for your entire life.

At Elder Law Guidance, we help you understand your options, reduce uncertainty, and move forward with confidence. When you are ready to protect your future, we are here to walk with you step by step.

Understanding Estate Planning in Kentucky

Estate planning is the process of creating clear instructions for your care, your finances, and your legacy so your family is protected no matter what life brings. In Kentucky, it also means understanding how local probate rules, Medicaid eligibility, and long term care costs can affect the people you love.

A thoughtful plan helps you decide who can make medical and financial decisions if you become unable to do so. It outlines how your home and savings are managed and inherited, and it provides a path to keep your family out of court and out of conflict.

For many families across Lexington, Richmond, Winchester, and Berea, these decisions offer a level of stability that feels especially important as they age.

Kentucky seniors face rising care expenses along with a growing need for trusted guidance. Assisted living communities in the region, including popular options like Legacy Reserve at Fritz Farm, have seen increased demand, and nursing home costs continue to climb.

Local families often come to us feeling unsure about the legal steps involved, but they leave with a clearer understanding of their options and the peace of mind that comes with a secure plan.

When you have a firm that explains everything in plain English and moves at your pace, the process becomes much more manageable. We are here to help you take that step with confidence.

Our Estate Planning Services in Kentucky

- Wills

- Trust creation

- Trust management

- Revocable Trusts

- Irrevocable Trusts

- Special needs trusts

- Financial powers of attorney

- Healthcare powers of attorney

- Living wills

- Advance Directives

- DNR documents

- Probate avoidance planning

- Beneficiary and property titling

- Asset Protection

- Estate tax planning

- Business succession planning

- Buy-sell agreements

- Charitable and legacy planning

- Charitable trusts and donor-advised funds

- Estate document review and updates

- Coordination with financial and tax advisors

- Medicaid Planning

Get Trusted Legal Support Today

For straightforward legal advice and representation, contact Elder Law Guidance. Call (859) 544-6012 to schedule your consultation.

Why Families Across Kentucky Choose Us

Families choose Elder Law Guidance because they want a team that listens, explains clearly, and treats them with respect.

“We needed to set up a trust and they explained everything clearly.” -Cathy Rigney

Families come to us when they need steady guidance through trusts, wills, probate, and elder care decisions. Many arrive unsure of where to begin, and they leave understanding each step with confidence.

“Called after hearing praises from another client.” -Victoria Bishop

Referrals and word of mouth bring many families to our office. People trust the recommendations of friends, neighbors, and relatives who have already experienced our patient, respectful approach.

“They calmed all fears during a traumatic time with my elder mother.” – Stacy Bland

During stressful moments, families want more than legal documents. They want kindness, time to ask questions, and the feeling that someone is walking with them. Our team provides that steady support.

“We have used their services for our parents and now for our own planning.” -Greenhat Custom

We often become a long term resource for families. Once clients experience our process, they return for updates, new planning needs, and guidance for the next generation.

“We moved from California to Kentucky and they helped us update everything.” -Eric Brown

Relocating families rely on our Kentucky-specific knowledge. Updating out-of-state documents can feel confusing, but clear explanations help clients feel confident they are making the right decisions.

How Estate Planning Protects Your Assets and Family in Kentucky

Estate planning helps Kentucky families stay in control of their property, finances, and medical decisions. Without a plan, your loved ones may face delays, added costs, and unnecessary stress.

For many families, the home is their largest asset. Tools like trusts can keep that property out of probate and ensure it passes smoothly to the people you choose.

Planning also helps protect savings from the high cost of care. Assisted living in Kentucky is expensive. Understanding Medicaid’s rules and asset limits early can prevent avoidable spend-down.

Just as important is naming trusted decision-makers. A power of attorney and health directive make sure someone you choose can manage medical or financial matters if you need help.

With the right guidance, estate planning becomes a straightforward way to protect your future and give your family lasting peace of mind.

About Elder Law Guidance

Elder Law Guidance was founded in 2015 with a clear purpose. Founder, Scott E. Collins, wanted to create a place where Kentucky families could protect what they have worked for and age with dignity, security, and peace of mind. That commitment guides every conversation we have, from the first phone call to the final signing of your documents.

Clients often tell us they feel respected and heard, and many express relief that complicated topics finally make sense. One reviewer wrote that working with our team felt like “speaking to someone we had known for a long time.” That sense of comfort matters, especially when planning for the later stages of life.

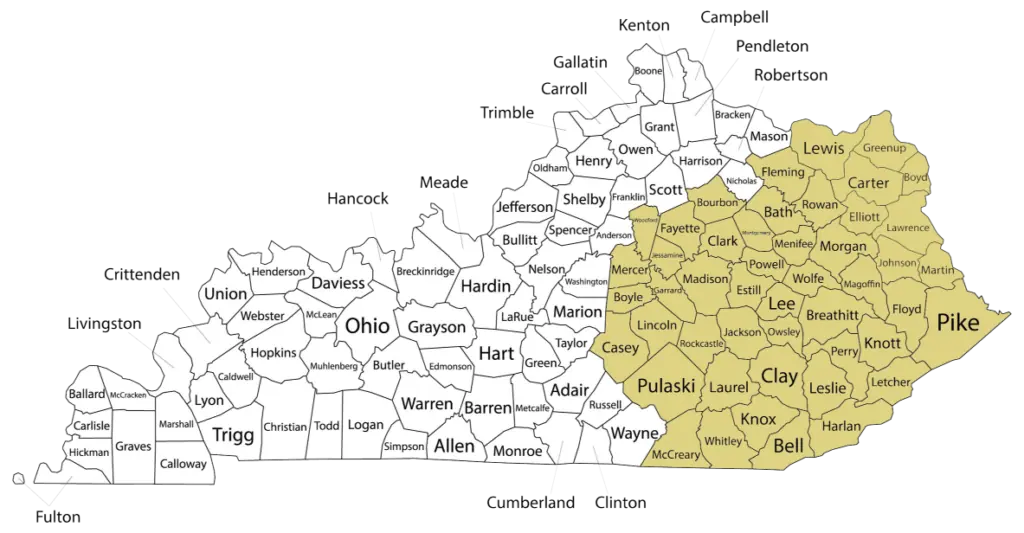

We serve families across Central Kentucky, including Lexington, Richmond, Winchester, and Berea. Our office sits in a welcoming historic setting, and we also meet clients at home, in the hospital, or in assisted living communities when needed.

Because we work closely with financial advisors, CPAs, care managers, and family members, your plan reflects both your legal needs and your personal goals.

Education is central to our mission. We host free webinars and community workshops that explain trusts, wills, Medicaid eligibility, VA benefits, and long term care planning in a way that feels calm and accessible.

Understanding Medicaid and Long Term Care Planning in Kentucky

Medicaid planning helps Kentucky families access affordable long-term care without losing the assets they’ve spent a lifetime building.

Kentucky Medicaid has strict income and asset limits, including a five-year lookback, which can create penalties if transfers weren’t planned correctly. With nursing home costs now averaging over $109,900 per year, knowing these rules is critical.

An individual applicant may have only $2,000 in countable assets, while a spouse at home may keep more under Kentucky’s spousal protections. Many families worry about qualifying without risking their home or savings, especially as demand for Central Kentucky communities like Legacy Reserve at Fritz Farm continues to grow.

Early planning can protect major assets, often by using Medicaid-compliant trusts or restructuring resources to maintain eligibility. This helps families avoid panic spend-downs and gives them more options for receiving care at home, in assisted living, or in a skilled nursing facility.

Our Estate Planning Process in Kentucky

Kentucky families often come to us after a medical emergency, a denied Medicaid application, or delays with VA benefits. Our process is designed to bring clarity and guidance at every step.

Step 1: Complimentary Consultation

We begin with a free consultation. Available in person, by phone, or online to understand your goals and the issues affecting your family.

Step 2: Personalized Planning Session

You then meet with an elder law attorney to review Medicaid eligibility, VA benefits, long-term care options, wills, and trusts under Kentucky law. Many families say this meeting brings everything into focus.

Step 3: Drafting and Signing Documents

We prepare the legal documents that make your plan official, including wills, trusts, and powers of attorney tailored to Kentucky requirements.

Step 4: Implementing Your Plan

Our team helps you fund trusts, retitle assets, and coordinate with financial and tax professionals to ensure your plan works in practice.

Step 5: Medicaid & VA Applications

For clients applying for Medicaid or VA benefits, we handle the entire application process and prepare thorough documentation to minimize delays.

Step 6: Ongoing Support

Many Kentucky families stay with our annual program for updates, plan reviews, and caregiver guidance. We also offer monthly workshops on Medicaid, VA benefits, and estate planning for communities throughout the state.

Local Resources for Kentucky Families

- Kentucky Department for Aging and Independent Living

- Kentucky Cabinet for Health and Family Services

- Fayette County District Court Probate Division

- UK HealthCare in Lexington

- Baptist Health Lexington

- Richmond VA Clinic

- Sayre Christian Village

- Legacy Reserve at Fritz Farm

- Morning Pointe of Lexington

- Bluegrass Area Agency on Aging

Schedule Your Estate Planning Consultation

Protecting your home, your savings, and your family does not have to feel overwhelming. A clear plan can give you comfort today and stability for the people you love tomorrow.

At Elder Law Guidance, we take the time to listen, explain your options in plain English, and guide you through each step with patience and respect.

If you are ready to understand your choices and secure your future, we would be honored to help. Contact us to schedule your consultation and take the next step with confidence.