Veterans’ pension is a tax-free monetary benefit designed to provide financial assistance to certain wartime veterans who have bravely served our nation or are permanently disabled.

Qualification for this benefit hinges on various factors, including service duration, yearly income, yearly limit and time of active military service. Understanding the eligibility regulations is crucial to accessing the benefits you rightfully earned through service if you believe you qualify.

At Elder Law Guidance, we understand that navigating the veteran’s pension benefits system can pose significant challenges for wartime veterans and their families. We can guide you through the veterans pension application process and work diligently to help you overcome the hurdles presented by the system.

In this guide, we briefly overview how the wartime veterans pension program works to keep you informed and share specific ways we can help with your case.

Understanding the Veterans Pension Benefits

The Federal Department of Veterans Affairs (VA) administers the Veterans Pension Program. It provides monthly tax-free payments to wartime veterans who meet specific criteria and their survivors.

To receive payment, a wartime veteran’s yearly family income and net worth must be under a specific figure ($155 356 as of 2024). But the total amount they can get each year under the program (called the Maximum Annual Pension Rate MAPR) varies depending on whether they

- Have dependents

- Are married to another veteran

- Qualify for additional benefits due to disability.

For example, the basic MAPR for 2024 is $16 551 for veterans without dependents. For veterans with at least one dependent, the basic MAPR is set at $21,674.

However, the specific amount that will be paid is calculated by considering the eligible veteran’s countable income (including that of their spouse), which may be earned from a job, retirement, or annuity payments. The value of the annual income will be deducted from the MAPR amount. Whatever is left is what will be paid as wartime veterans pension (pro rated monthly).

You are allowed to deduct certain medical and educational expenses when calculating your income. Failure to deduct these expenses when appropriate could reduce the amount you get as pension payments. Correctly calculating your income and net worth is therefore crucial to assessing wartime veterans pension.

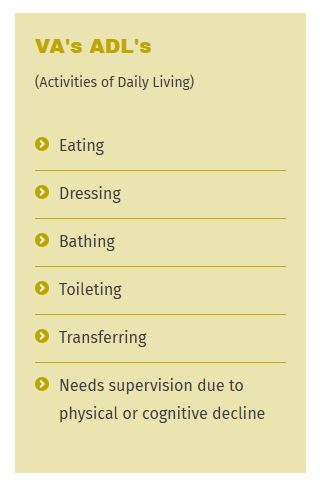

VA’s ADL’s

(Activities of Daily Living)

- Eating

- Dressing

- Bathing

- Toileting

- Transferring

- Needs supervision due to physical or cognitive decline

The money comes directly to your personal checking account and may be spent on any needs you have. This can be a life-saving benefit giving you the means to afford in-home care, to supplement income so that you can afford assisted living, or to ensure that you are able to care for your spouse if you were to pass away before he or she does.

How Much Is The Benefit?

Additional Allowances

Surviving spouses and children of wartime veterans with a net worth below $155,356 may also be eligible for VA survivors’ pension benefits. The amount a surviving spouse can get depends on their income and the number of dependents they have. However, the amount paid to a surviving child is fixed at $2,831 annually.

Qualified veterans and surviving spouses who are housebound or require the aid and attendance of another person due to mental or physical incapacity may be entitled to additional allowances and are typically assigned a higher MAPR. If you believe you qualify for additional allowances or survivor pension, don’t hesitate to get in touch with a VA veterans pension attorney to confirm your case and obtain the benefits you deserve.

Eligibility Criteria for VA Wartime Veterans Pension

In addition to meeting the net worth requirement stated in the previous section, you must also meet other conditions to qualify for this pension as follows:

- You received an honorable discharge.

- You meet the service requirements. That is, you:

- Commenced active duty before September 8, 1980, and served a minimum of 90 days with at least one day during a wartime period; or

- You began active duty as an enlisted individual after September 7, 1980, and served for a minimum of two years or the full period you were called/ordered to serve on active duty, with at least one day of service during wartime; or

- You were an officer who started on active duty after October 16, 1981 and had not previously served actively for at least 24 months.

- You are 65 or older, have a permanent and total disability, or get Social Security Disability Insurance or Supplemental Security Income.

Common Misconceptions About VA Pension Eligibility

Many believe that for a wartime pension claim based on permanent and total disability to succeed, the disability must be service-connected or commenced after the veteran entered active duty, which isn’t the case.

Furthermore, it’s often misunderstood that this pension only provides financial support for wartime veterans in nursing home care or who require long-term care to offset the expensive healthcare costs. On the contrary, it applies to any veteran who meets the service, age, disability, and financial requirements.

It is important to eliminate any assumptions you might have about the program to avoid being deterred by them. At Elder Law Guidance, we stand ready to explain the facts about the VA wartime pension requirements and dispel any inaccurate notions about them so you don’t lose the benefits you are entitled to.

Application Process for VA Wartime Veterans Pension

The pension claim process involves

- Confirming your eligibility based on the stated requirements

- Completing the application form (VA Form 21P-527EZ)

- Submitting the form to the Department of Veterans Affairs by mail, online, in person, or through an accredited representative.

You’ll also need to obtain certain documents and include them in your application to support your claim. These documents may include

- Discharge papers

- Financial records

- Medical records if you are under 65

- Anything else that shows your eligibility for the pension

Tips for a Successful Application

Other than confirming your eligibility, the major factor that determines your eligibility for a VA pension is the accuracy and completeness of the information and documents provided during the application process. That’s why it is important to get professional help from experienced attorneys who can ensure that there are no mistakes in your application and that you’ve done all you’re required to do to fulfill the requirements.

Planning for the Future with VA Benefits

Before you apply for VA Pension, you may need to undergo long-term financial planning. This would allow you to assess your overall financial state, including your countable family income, and organize your assets to ensure they do not affect your eligibility.

Long-term financial planning also allows you to consider additional veterans benefits and how they interact with the pension. For example, you may qualify for both VA disability compensation and VA wartime pension. But you can’t get paid under both programs at the same time. If you apply for both, the VA will pay you the benefit with the larger amount. Therefore, when you qualify for several benefits, proper planning allows you to focus your efforts on those likely to yield the most results.

Your Kentucky VA Wartime Veterans Pension Attorneys

As a wartime veteran or the surviving spouse of a wartime veteran, you may be entitled to certain VA pension benefits. Knowing your eligibility and navigating the challenging application process can be crucial to your success and financial security.

Our experienced attorneys at Elder Law Guidance stand ready to assist you and protect your assets while maximizing the benefits available to you as a veteran.

Why Choose Us?

- Client-Focused: We prioritize your needs, tailoring our services to your circumstances.

- Passionate Advocacy: Our firm is driven by a commitment to honor the service of our veterans.

- Caring Approach: We handle your concerns with empathy and respect, aiming to alleviate your burden.

- Trust: Our reputation in Richmond, Kentucky, is built on trust and the quality legal services we provide.

We encourage you to contact Elder Law Guidance for clear answers and compassionate assistance. Let us help safeguard your future and that of your loved ones.

Frequently Asked Questions About VA Wartime Veterans Pension

Who Qualifies for the Pension?

Veterans must meet wartime service, income/net worth limits, and age/disability criteria.

Does the Pension Affect Other Benefits?

It does not reduce Social Security, but may interact with Medicaid.

Can Surviving Spouses Apply?

The spouse or child of a deceased veteran with wartime pension can apply for VA pension. This is if they meet income thresholds and the veteran met service requirements.

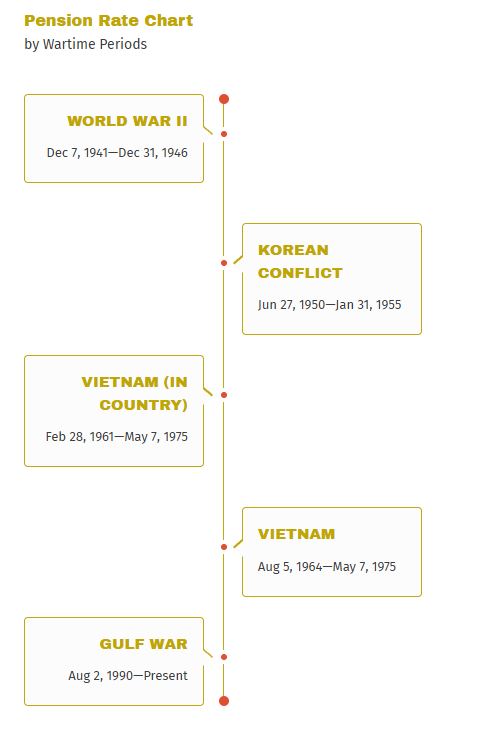

What Counts as “Wartime Service”?

A veteran with wartime service had active duty during VA-recognized conflict periods, even without combat.

How Is Income Calculated?

The VA deducts unreimbursed medical expenses from gross income.