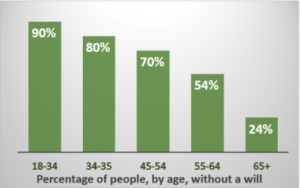

From the Legacy Estate Planning Newsletter I found some staggering numbers. It’s a concern to be informed that so many people of all ages and backgrounds have this one thing common: They don’t have a will.

Here are 10 reasons to have a will:

1.You get to decide who’s in charge–By designating an executor of your estate, you can choose how your assets are handled, not the courts.

1.You get to decide who’s in charge–By designating an executor of your estate, you can choose how your assets are handled, not the courts.

2. You can help avoid familial disagreements–A will provides for a clear division of assets to provide a less stressful and potentially contentious process of your family and heirs.

3. Ease the grieving process–Being prepared can help protect your family from having to make complicated financial decisions while grieving.

4.Reduce your taxes–Estate taxes and taxable assets can impact you estate and your heirs. A will can help reduce these amounts.

4.Reduce your taxes–Estate taxes and taxable assets can impact you estate and your heirs. A will can help reduce these amounts.

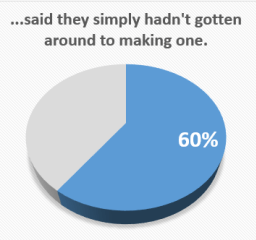

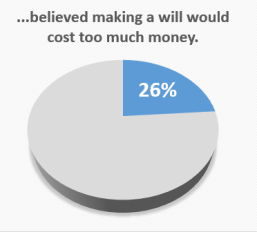

5. It’s not as expensive or difficult as you may think–The average will is straightforward and easy to prepare. Many attorneys offer free consultations and/or flat fees to prepare one.

6. Care for your children–Should a parent or guardian die before their child(ren) is 18 years old, a will is needed to determine their designated guardian. Otherwise, this decision will be left to the courts.

7. Maintain you small business–If you’re an entrepreneur or small business owner, a will can help you avoid leaving behind a business with no clear plan for succession or future earnings.

7. Maintain you small business–If you’re an entrepreneur or small business owner, a will can help you avoid leaving behind a business with no clear plan for succession or future earnings.

8. Minimize or eliminate probate–Having a clear-cut document with instructions on how to divide your assets helps avoid delays and can save time and money.

9. You don’t know when your time will come–No day is promised to us, and sadly an accident or medical event could occur at any moment and at any age. A will is important, even for younger people.

10. You can continue to give to what matters to you–Passionate about your church, alma mater, or other nonprofit? Donating though your estate is often an effective strategy to reduce your estate’s tax burden and support your favorite organizations.

10. You can continue to give to what matters to you–Passionate about your church, alma mater, or other nonprofit? Donating though your estate is often an effective strategy to reduce your estate’s tax burden and support your favorite organizations.

It won’t cost much time or money to have a will created, but it could cost you everything and create turmoil for your loved ones if you don’t have one.

Contact us today and take control of your future! We are happy and excited to help you do everything you can to protect what you own and everyone around you!

Contact us today and take control of your future! We are happy and excited to help you do everything you can to protect what you own and everyone around you!

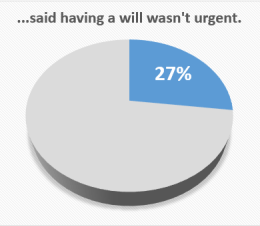

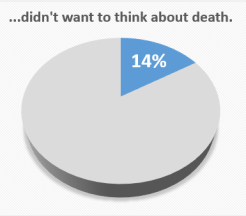

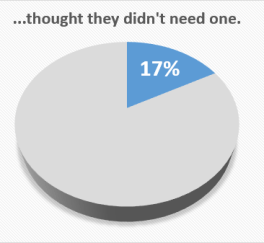

The Legacy Estate Planning Newsletter comes from Abilene Christian University. The statistics for the pie charts were established by the respondents in the multi-year Rocket Lawyer/Harris Poll when asked, “why don’t they have a will?”